In restating its results for the past three years, Xerox Corp. conceded it had "misapplied" a range of accepted accounting rules, including some related to its huge copier-leasing business.

But it is unclear whether that acknowledgment will go far enough to satisfy the Securities and Exchange Commission, which has been looking into Xerox's accounting, or to insulate Xerox from further write-downs.

The SEC wants to know if Xerox changed the lease-accounting assumptions in order to give revenue and profit an artificial boost in Latin America and possibly elsewhere, according to people familiar with the case.

Executives at Xerox's headquarters in Stamford, Conn., ordered the company's Mexican unit to adopt the more favorable assumptions in the late 1990s, according to an excerpt from a confidential internal report commissioned by the Xerox board's audit committee. The report, by lawyers at Akin, Gump, Strauss, Hauer & Feld and accountants at PricewaterhouseCoopers and completed in December, didn't take a position on whether the accounting change was appropriate, but noted that it had been approved by Xerox's outside auditor, KPMG LLP.

A Xerox spokeswoman said the company had used proper accounting assumptions, and that it only included the additional disclosure in its filing Thursday to give stockholders more information at a time when the company's accounting is facing scrutiny.

Xerox has said the SEC is conducting a broad inquiry into its accounting practices, including those in Xerox's Mexico unit. Xerox has said the Mexican subsidiary improperly booked revenue and hid bad debts, and last year took a $120 million charge to cover the problems, but that wasn't related to the separate issue of accounting assumptions for leases.

SEC investigators last month spent considerable time grilling former Xerox finance executive James F. Bingham about the lease-accounting issue, according to people familiar with the matter. Mr. Bingham, who is suing Xerox for wrongful termination, in December gave the SEC a copy of his estimate that Xerox had improperly booked $447 million in pretax income over roughly a half-dozen years, principally in Latin America, because of aggressive discount-rate assumptions in booking leases. A spokesman for the SEC declined to comment, citing commission policy.

If the SEC finds the accounting assumptions used by Xerox were improper, the company might be forced to restate past results again. In addition, the issue could complicate Xerox's efforts to get out of the equipment-financing business, a major part of its plan to shed debt and return to profitability. Accounting experts say that using improper assumptions in booking leases would result in overstated receivables, or assets, on a company's books. A buyer of those leases likely wouldn't pay face value for assets that might be deemed inflated.

The Xerox spokeswoman said the discussions to quit the equipment-financing business "remain on track."

The accounting assumption in question involves the discount rate Xerox uses to estimate the value of future payments from the leases. The company's decision to adopt a lower discount rate for lease-accounting purposes in the late 1990s had the effect of increasing the upfront revenue booked by the company.

Such discounting is effectively a way of reconciling that money paid later is worth less than it is today. It is the same idea used by other companies in treating similar leases -- or by state lottery commissions, which give winners the choice of getting, say, $1 million over 20 years, or $400,000 today.

Leases are especially tricky in such Latin American nations as Brazil and Mexico, where interest and inflation rates are high. Brazil was one of Xerox's largest markets, annually contributing between 8% and 10% of corporate revenue from 1996 to 1998. Mexico was also a fast-growing market.

In booking sales-type leases in high-inflation countries, the discount rate employed should be the implicit interest rate used to set payments in the lease contract, and should be "close to local interest rates," said Kimber Bascom, a fellow at the Financial Accounting Standards Board, the Norwalk, Conn., body that sets the basic rules on booking leases. The high local rates, he said, reflect the likelihood that future lease payments will be worth significantly less due to inflation and currency devaluation.

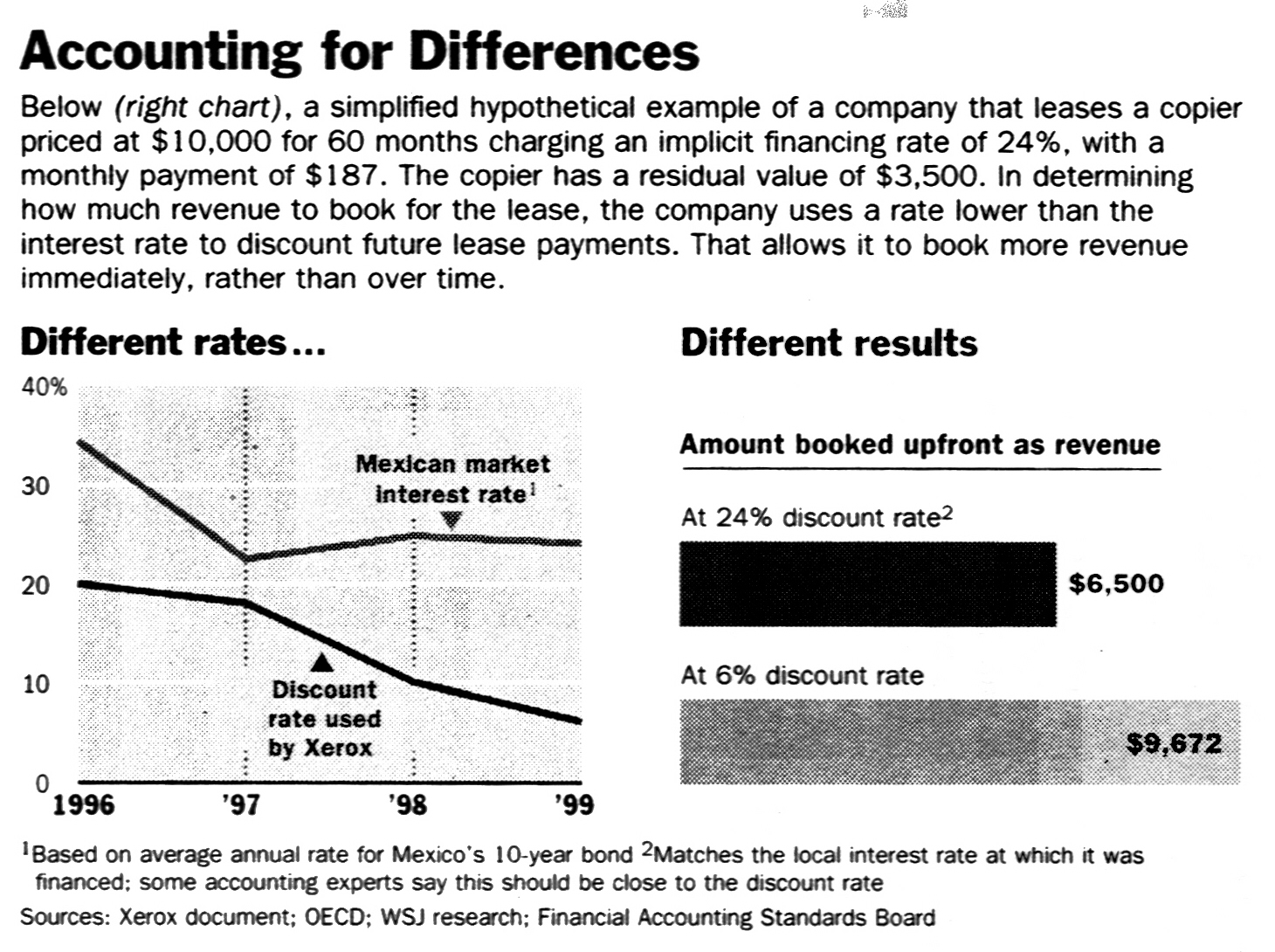

But in Mexico, Xerox rapidly reduced the discount rate to far below local interest rates during the late 1990s, according to the Akin Gump report. The report said Xerox Mexico booked leases using a discount rate of 20% in 1996 for contracts written in Mexican pesos. The unit reduced that rate to 18% in 1997, 10% in 1998 and 6% in 1999, the report said, at the direction of headquarters, as part of a wider change in Xerox's accounting "methodologies and practices."

During the same period, according to the Organization for Economic Cooperation and Development, the average Mexican interest rate on 10-year bonds fell to 22.5% in 1997 from 34.4% in 1996, but then jumped up slightly the following two years. In 1999, when Xerox was assuming a 6% discount interest rate, the Mexican 10-year rate was four times higher, or 24.1%.

Booking a lease using a 6% discount rate, compared with 24%, results in a "huge impact" in the amount of revenue that a company can book upfront, Mr. Bascom of the FASB said. Using a hypothetical machine leased over five years, Mr. Bascom figures a company could book about 50% more revenue upfront with the lower discount rate. The action doesn't fabricate revenue, but accelerates some revenue the company would have booked over a number of years.

Another internal Xerox document, marked "confidential," lists the discount-rate shift as the largest of 10 "one-time" accounting "actions" used by Xerox Mexico that had the effect of boosting results in 1999.

Xerox declined to discuss the details of how it sets discount rates to record leasing revenue outside the U.S., saying only that the local interest rate is just one of a "number of different factors."

Mr. Bingham told the SEC in an earlier deposition in December that Xerox managers were rewarded for coming up with ways to lower the discount rate, an action that typically happened toward the end of a quarter. "That would accelerate revenue, and then there would be bonuses given," Mr. Bingham said in his testimony, along with favorable personnel reports and "attaboys."

According to a transcript of his testimony, Mr. Bingham said that Xerox used similarly rosy interest-rate assumptions in Brazil. Instead of a 30% rate, which Mr. Bingham said would have been appropriate, Xerox by the late 1990s was using a 6% rate. Brazilian treasury-bill rates from 1997 to 1999 ranged between 24.8% and 28.6% as an annual average, according to the International Monetary Fund.

Mr. Bingham also told the SEC that Xerox used the lower rates because "there is no way" managers in the company's developing-markets unit would have been able to meet their revenue target for the year 2000 if they had used the higher rates.